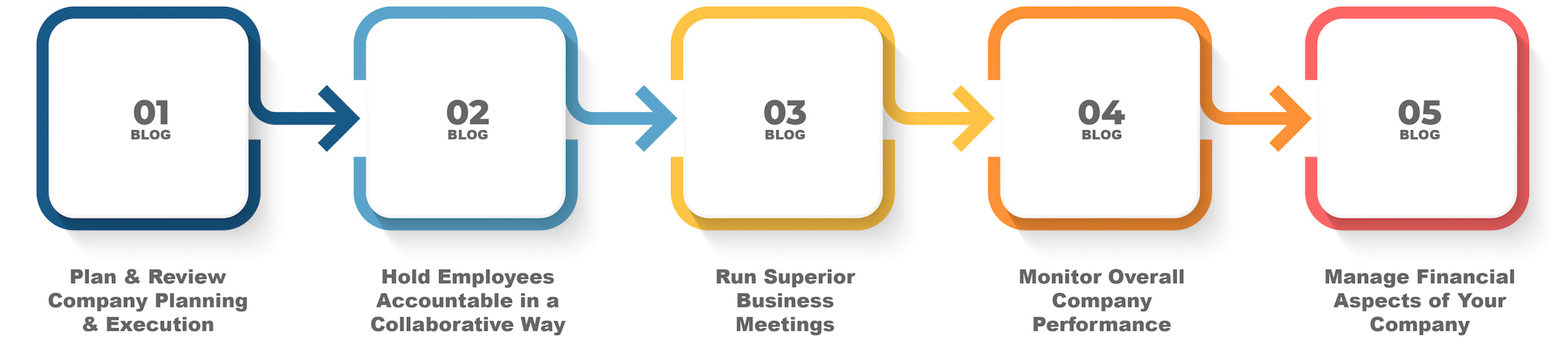

5 Common Blind Spots Leaders Have Are Not Seeing How To:

Blind Spot #5 – Managing the Financial Aspects of Your Company

This article focuses on the fifth of five blind spots many business owners have when trying to grow from 5 to 50 employees. In our previous article, we discussed the first blind spot: not seeing the value around consistent company planning. The second blind spot focussed on how to maintain employee accountability, while the third highlighted seeing the importance of high-quality weekly management meetings. Last week, we highlighted the importance of efficient company performance monitoring, which brings us to the final blog of our series.

The fifth blind spot involves not managing the financial aspect of the company. Too often business owners begin their business on a shoestring and adapt to monitoring cashflow by how much money they have in their bank account. Although this is never advised it can work initially when the financial numbers and expenses are small. This quickly changes however, and when revenues and costs go up it becomes impossible to manage cashflow based on your balance.

Financial Management Pitfalls

The most classic miscalculations come in the form of tax bills and annual costs that are not amortised over the whole time period. These ‘lumpy’ sporadic bills often drain the business accounts unexpectedly. If too many of these surprises sneak up on you, the business rapidly develops significant issues.

Too often, the first strategy used by entrepreneurs is to forgo paying their taxes. The tax department then transitions to becoming a lending institution, with excessive rates of interest that only slip you further down the slope. This dynamic often continues indefinitely. When the company does well enough on the sales side of the ledger, it can work its way out of debt, but too often the weight and stress of the tax bill become too much for the company and owner. This self-perpetuating dynamic continues, and eventually becomes too much for the company to endure.

Outsourcing Financial Management

It doesn’t have to be that way. We find that eliciting the help of an outside entity like a virtual CFO can dramatically improve both the dynamics and likelihood of business and financial success. A CFO-like advisor can act as an objective third party by removing the financial management blind spots and quickly implementing objective checks to monitor how the company is financially performing. This gives you greater accountability and streamlines the process of managing your outgoing financials.

A more specific financial management blindspot that virtual CFOs can help with is with cashflow forecasting. Even the most basic types of financial disciplines involve monitoring financial results in the form of monthly and quarterly financial reporting. Looking into the future is as important as looking in the rearview mirror at how a company has performed. Effective forecasting offers insights into how the company will perform, providing all-important feedback on what adjustments need to be made now to assure future financial success.

Financial Management: Conclusion

In conclusion, it is important to recognise one’s desire to guess how their company is performing. This avoidance of objective and predictive information exposes an owner and their business to a great deal of unnecessary risk. Virtual CFOs are wildly cost-effective. Thus it is fitting to say, ‘an ounce of prevention is worth a pound of cure’! Remove the financial management blind spot today and start better monitoring both what the company’s needs are now as well as how it will likely be performing over the next 30-60 days.

Until next time, enjoy the process!