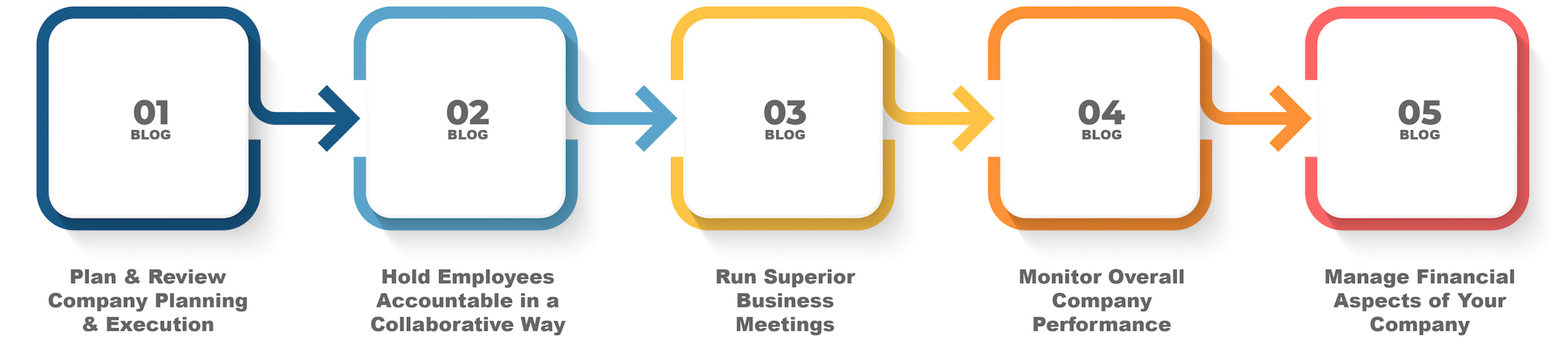

Performance Monitoring

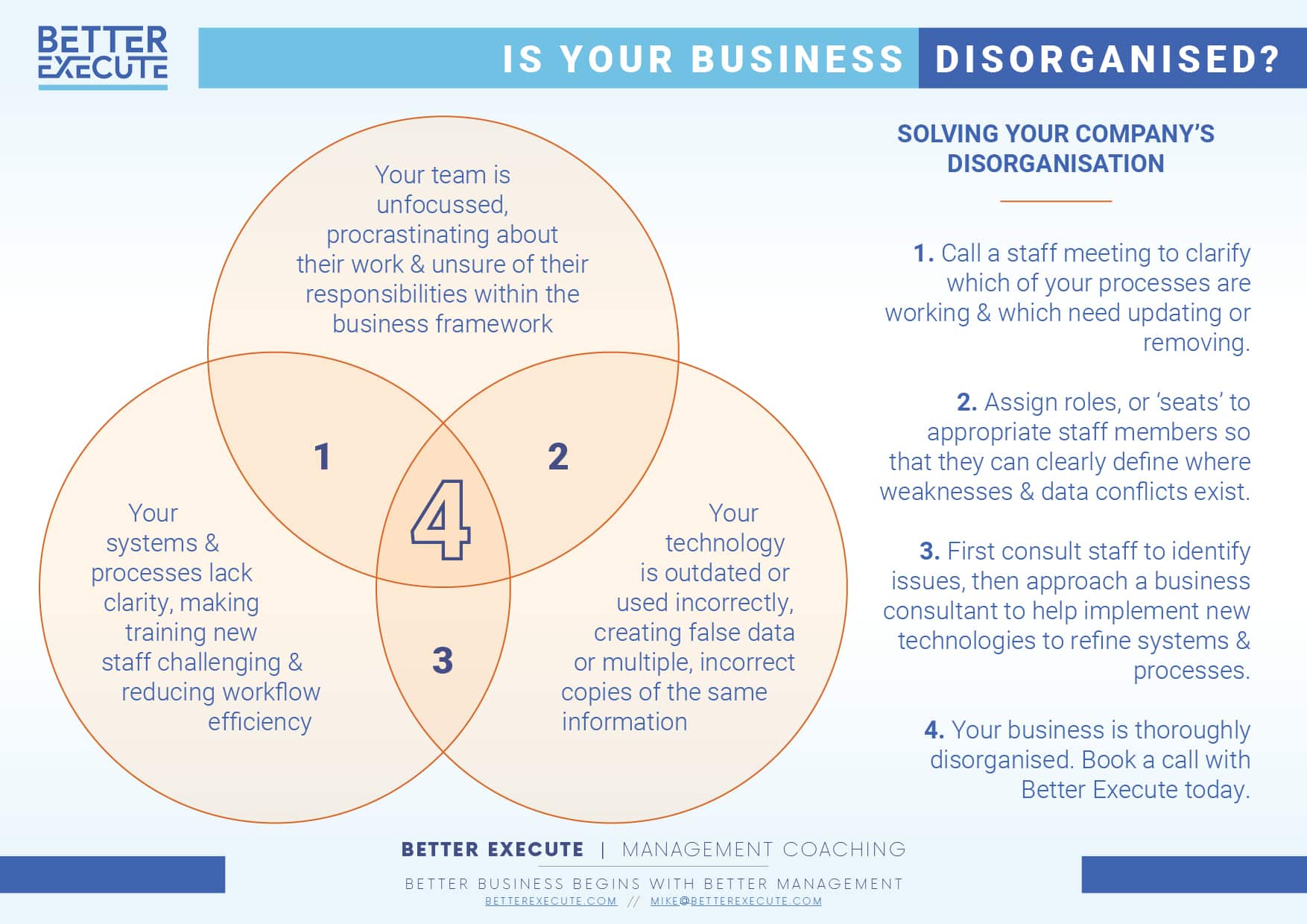

Performance monitoring is critical for businesses of all sizes. It helps managers understand how well the organisation is performing against its goals and objectives.

To reiterate on previous lessons, here are the reasons why performance matters and why it is essential to track and measure it consistently.

- Tracking performance helps you identify areas in which your business is doing well and where it needs improvement. By setting key performance indicators (KPIs), you can measure your progress towards your goals and identify any areas where you need to make changes. This allows you to focus your resources on the areas that will have the most significant impact on your business.

- Performance monitoring helps you identify and address issues early on. By regularly measuring your performance, you can quickly identify any problems and take corrective action before they escalate. This can help you avoid more significant issues down the line and ultimately save you time and money.

- Tracking performance can help you make more informed decisions. By having data to back up your decisions, you can make more confident and accurate choices. This is particularly important when making strategic decisions that can have a significant impact on your business’s future.

- Monitoring performance can help you stay competitive. By tracking your performance against your competitors, you can identify the areas in which you need to improve to stay ahead of your adversaries. This allows you to adjust your strategy and tactics to stay relevant and competitive in your industry.

- Lastly, monitoring performance can help you motivate your employees. By setting KPIs and regularly sharing performance data, you can help your employees understand how their work contributes to the overall success of the business. This can motivate them to work harder and perform better, leading to better overall results.

Performance monitoring is critical to the success of any business. By identifying the right KPIs and tracking performance consistently, you can identify areas where you need to improve and take corrective action early on. This can help you stay competitive, make more informed decisions, and ultimately, drive better results. Remember, what gets measured gets managed, so don’t neglect performance monitoring in your business.

Key Performance Indicators

KPIs are metrics used to evaluate the performance of a particular activity or process. They provide a clear picture of how well your business is doing and help you make informed decisions. Let’s take a closer look at some common KPIs for different departments in your business.

Marketing KPIs:

The goal of marketing is to increase brand awareness, generate leads, and ultimately, drive revenue. Therefore, marketing KPIs should focus on metrics that help you track the effectiveness of your marketing campaigns. Some common marketing KPIs include website traffic, lead conversion rates, cost per lead, and customer acquisition cost.

Sales KPIs:

The sales department is responsible for converting leads into paying customers. Sales KPIs should focus on metrics that help you track your sales pipeline and revenue generation. Some common sales KPIs include sales growth, conversion rates, average deal size, and customer lifetime value.

Service Delivery KPIs:

The service delivery department ensures customer satisfaction by delivering high-quality products or services. Service delivery KPIs should focus on metrics that help you measure the quality of your products or services and customer satisfaction. Some common service delivery KPIs include customer satisfaction rates, customer retention rates, service response times, and service level agreements.

Operations KPIs:

The operations department manages the smooth running of your business. Operations KPIs should focus on metrics that help you measure the efficiency of your operations and identify areas for improvement. Some common operations KPIs include inventory turnover, order fulfilment cycle time, quality control metrics, and on-time delivery rates.

Human Resources KPIs:

The human resources (HR) department manages the people in your business. HR KPIs should focus on metrics that help you track the effectiveness of your HR policies and practices. Some common HR KPIs include employee turnover rates, absenteeism rates, training and development metrics, and employee satisfaction rates.

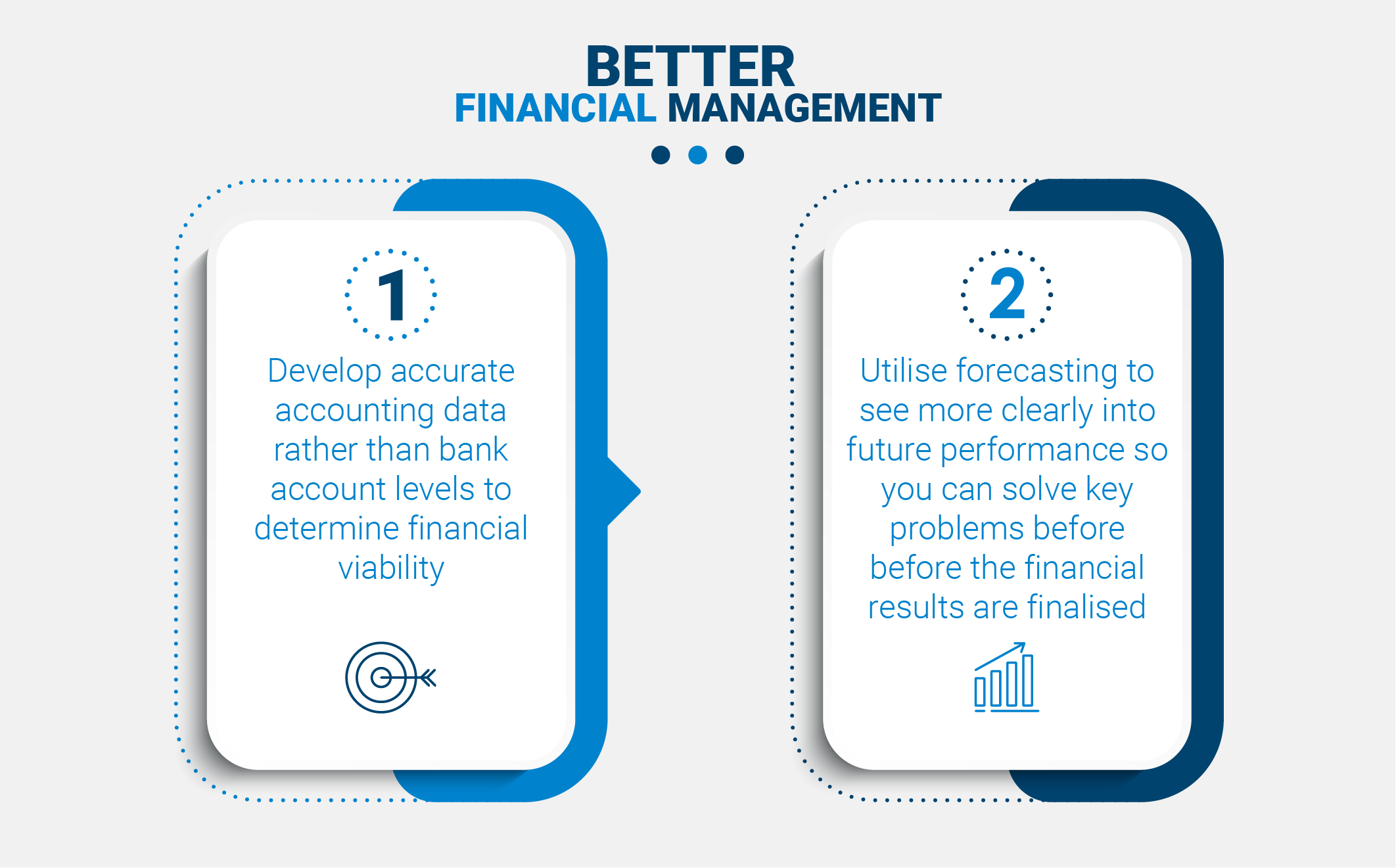

Finance KPIs:

The finance department is responsible for managing your business’s finances. Finance KPIs should focus on metrics that help you track your financial health and identify potential areas of risk. Some common finance KPIs include revenue growth, profitability ratios, debt-to-equity ratio, and cash flow.

In addition to these department-specific KPIs, there are also some KPIs that are relevant to all businesses, regardless of the department. These include:

Customer Acquisition Cost (CAC):

This metric helps you understand how much it costs to acquire a new customer. By tracking this metric, you can identify areas where you can reduce your costs and improve the efficiency of your marketing campaigns.

Net Promoter Score (NPS):

I only use this measurement because it is a well known example. These days with VoC AI functionality exploding NPS is feeling more and more like a fairly crude strategy. None-the-less, NPS is a measure of customer loyalty and satisfaction. By tracking your NPS, you can identify areas where you need to improve your products or services and build a loyal customer base.

Customer Churn Rate:

Customer churn rate measures the rate at which customers stop doing business with you. By tracking this metric, you can identify areas where you need to improve customer retention and loyalty.

Employee Productivity:

Employee productivity measures the output of your employees. By tracking this metric, you can identify areas where you need to improve your business processes and optimise your workforce.

Although these are viable and frequently used KPIs, companies vary greatly in what they should be measuring. Thus, developing an effective scorecard often takes several iterations to finalise. Over time and constant use, further refinements will likely be identified with some small adjustments happening every year.

Monitoring KPIs is essential for every business. By tracking the right KPIs, you can gain valuable insights into your business’s performance, identify areas for improvement, and make informed decisions. Remember to choose KPIs that are relevant to your specific business outcomes.

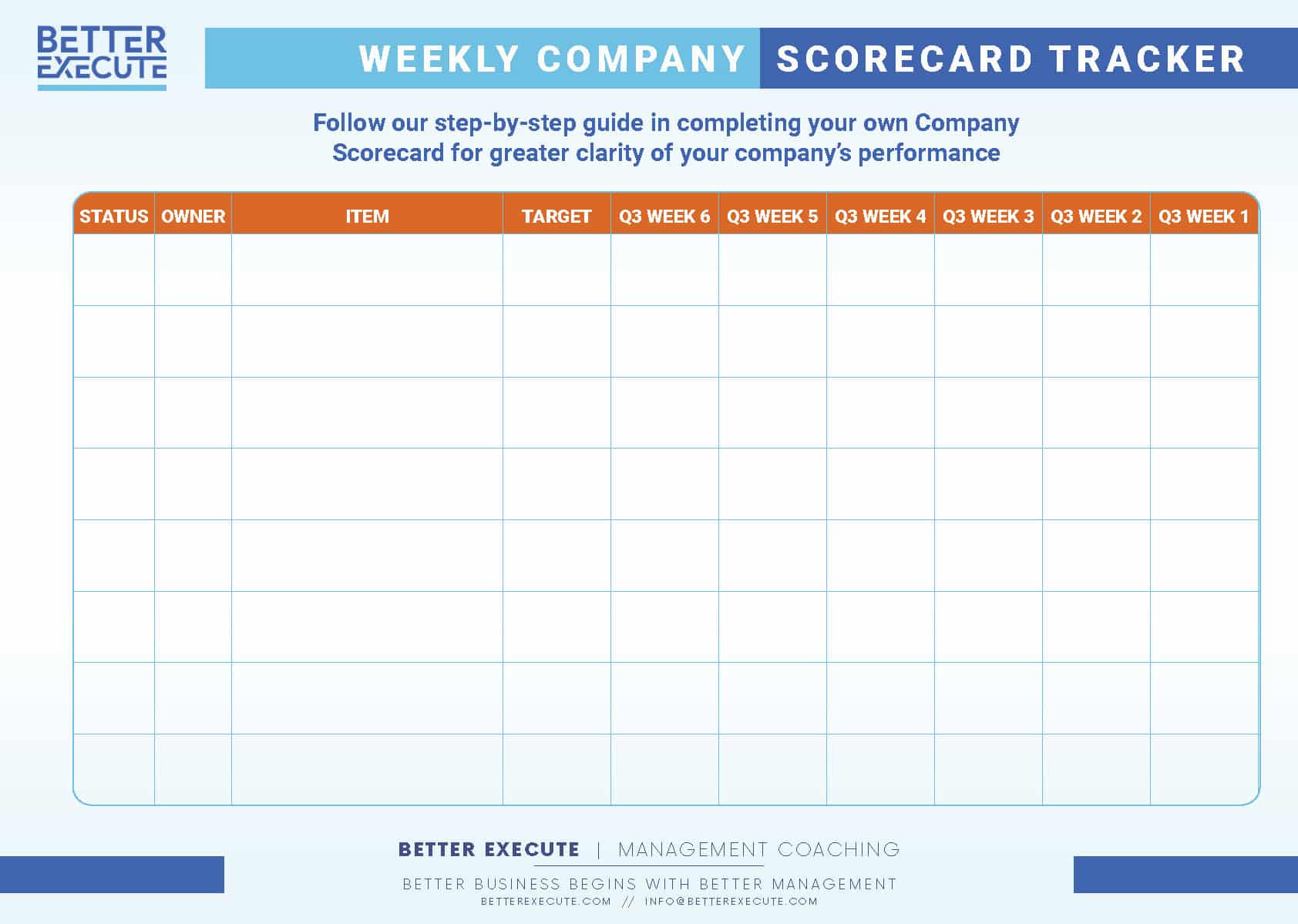

How to Monitor

As you likely know, one of the best tools for monitoring your business activities is with a company performance scorecard. A scorecard is a visual representation of your business goals and KPIs. It provides a quick snapshot of how well you’re doing in each area of your business and highlights areas that may need attention.

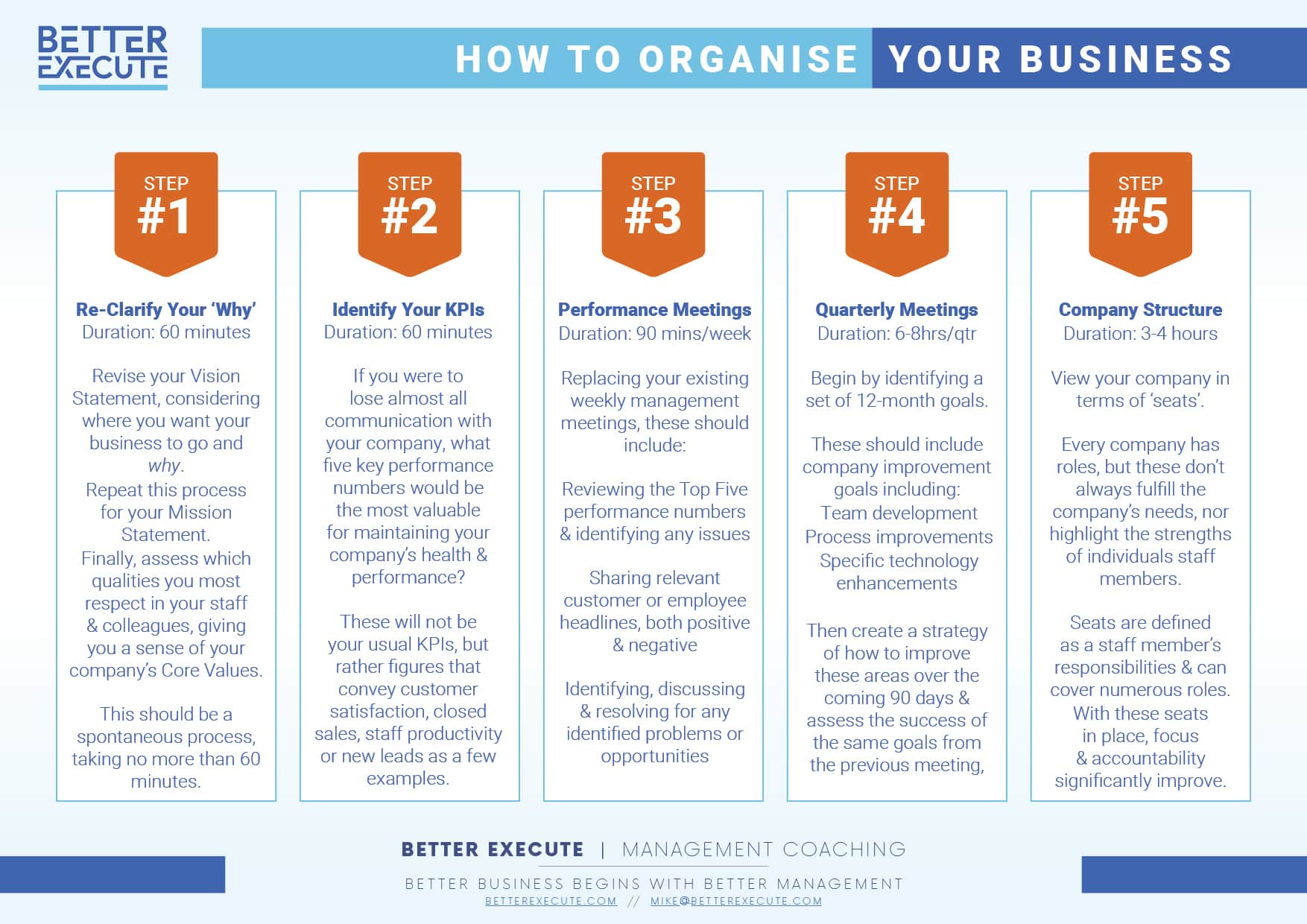

Here are the steps to create an effective scorecard. You can download our infographic on how to create your company scorecard at the end of this blog:

STEP 1: Decide on the areas of the business you want to measure and what types of activities are most important to monitor.

Before you can create a scorecard, you need to define your business goals and KPIs. Refer to the KPIs we discussed above and identify which ones are most relevant to your business. These KPIs should align with your business goals and objectives. .

STEP 2: Choose your specific measurement metrics, or ‘what’ you will measure to monitor your teams performance in a specific area of your business. The art will be in finding numbers that are both efficient to measure and effective at providing you feedback on whether something is working or has problems.

For example, if you want to monitor customer satisfaction, you could measure it using a Net Promoter Score (NPS) or in-person customer satisfaction surveys. NPS is an example of something quite efficient to measure with numerous third-party applications available. However, it is quite crude in its ability to provide an informed overview on how the customer really feels about a company, thus not all that effective compared to other options. In-person customer satisfaction surveys will often generate far more value and insights from the customer feedback thus being highly effective. However, they can take a great amount of resources to conduct consistently over time, so aren’t particularly efficient.

Obtaining an efficient and effective company scorecard can require some time to get right. It may take several tries and tweaks to get the balance between measuring real performance and the difficulty of getting the data into a weekly scorecard, but the effort will ultimately more than compensate your efforts.

STEP 3: Set targets for each item. Whenever possible the KPIs should be updated on a weekly reporting cycle because you will be reviewing the scorecard on a weekly basis. For example, if your objective is to sell $400,000/month, the scorecard KPI should be $100,000 to align with weekly reporting results. Although many activities and KPIs can be tracked weekly, other numbers may only be reported on or calculated monthly, such as Net Profit which requires you to aggregate a number of costs that only occur monthly.

Step 4: Assign responsibility for each of the numbers. Make sure that each KPI has a clear owner who is responsible for monitoring and reporting on it. This will ensure that there is accountability and that KPIs are not overlooked. A pro tip is to assign a backup person in case the KPI owner does attend the weekly meeting.

STEP 5: One thing I have learned from helping companies implement the Great Game of Business or other incentive type programs is the value of forecasting. It is good to report on a ‘leading’ indicator. When appropriate, it is even better to include a forecasted number that pushes the performance owner to think about and share what is achievable by the end of the month – or even subsequent months.

I find this practice of forecasting numbers enhances the quality of conversations on how the company is performing in any particular area. It often highlights concerns or weaknesses that generally just remain in team member’s mind when forecasting isn’t used.

Step 6: Now that you have defined your goals, KPIs, metrics, and targets, it’s time to create your scorecard. Your scorecard should include each KPI with the metric you’re using to measure it, and your target for that KPI. You can create your scorecard using a simple spreadsheet like the one provided below or a more advanced dashboard software if appropriate.

Conclusion

Monitoring your business activities is critical to achieving your business goals. A scorecard is a powerful tool for tracking your KPIs and providing a visual representation of your progress and problem areas. Additionally, holding regular meetings and assigning responsibility can help you stay on top of your business activities and ensure that you’re on track to success. Thank you for watching, and we’ll see you in the next video.

And as always, if you have any questions on implementing this strategy don’t hesitate to contact us for some insights that have worked for other companies like yours.

Until next week, enjoy the process!