Last week we outlined three key areas in which work stress can arise.

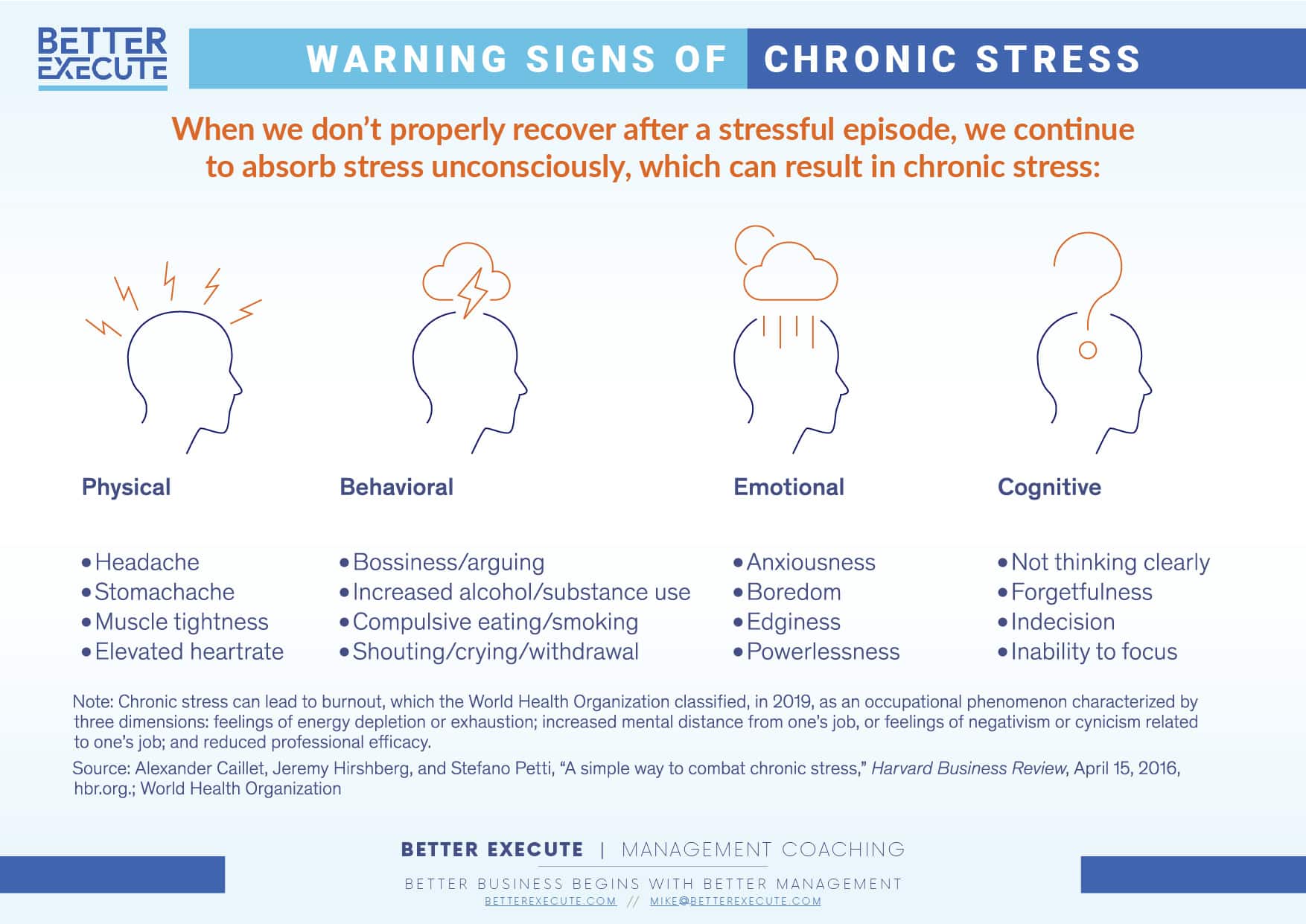

Cash insecurities, team performance and an accumulation of random problems can all add towards elevating work stress, eventually impacting your capabilities, your personal life and your physical and mental health. From there, we explored real-life scenarios in which our clients had rectified these work stress triggers, removing their own issues and creating a far more balanced workflow.

It’s all well and good to hear about the negative effects of stress and a few scenarios where people were able to decrease some of the work stress creators in their lives, but what can you do today to begin getting your chronic stress triggers under control?

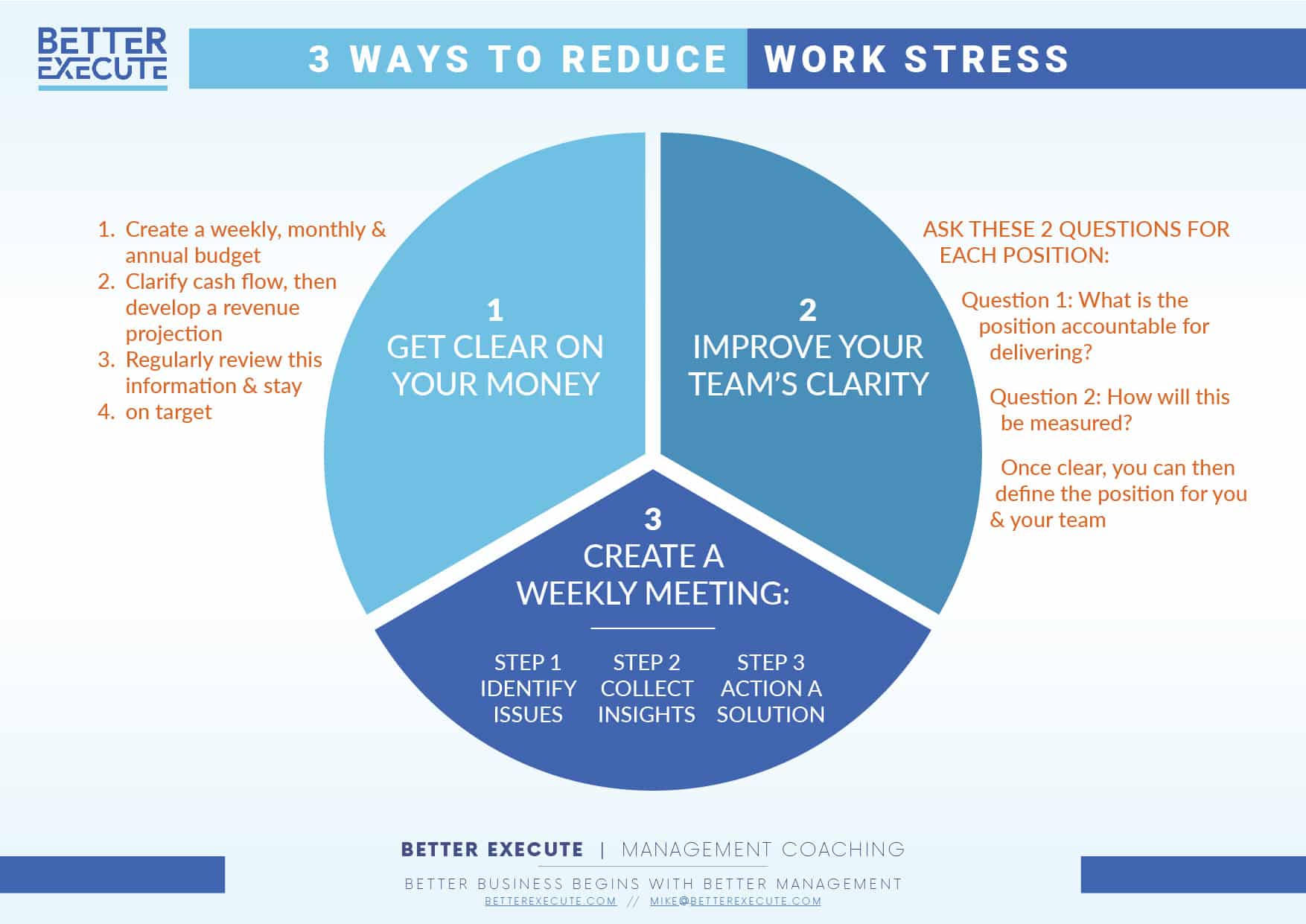

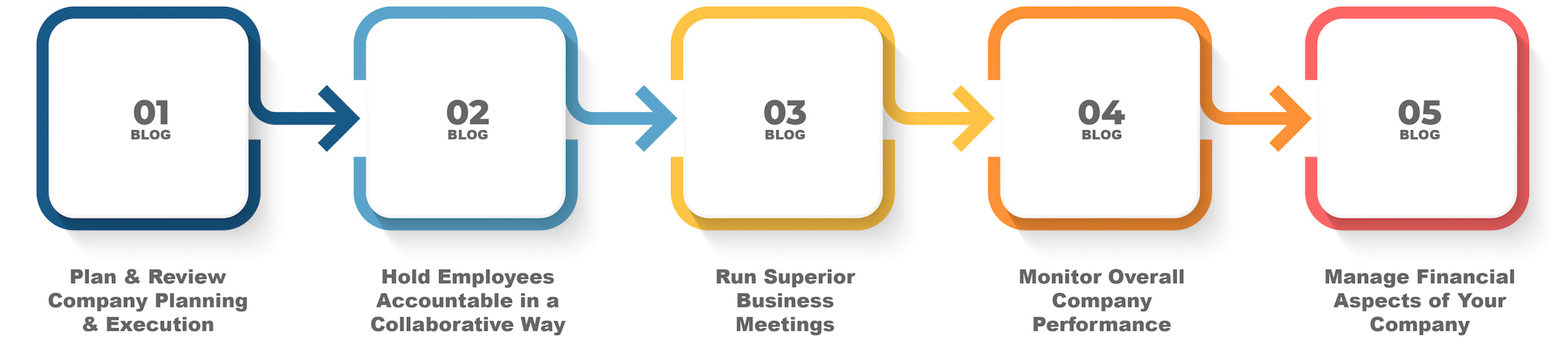

Three Strategies for Removing Work Stress

Get Clear on Your Money

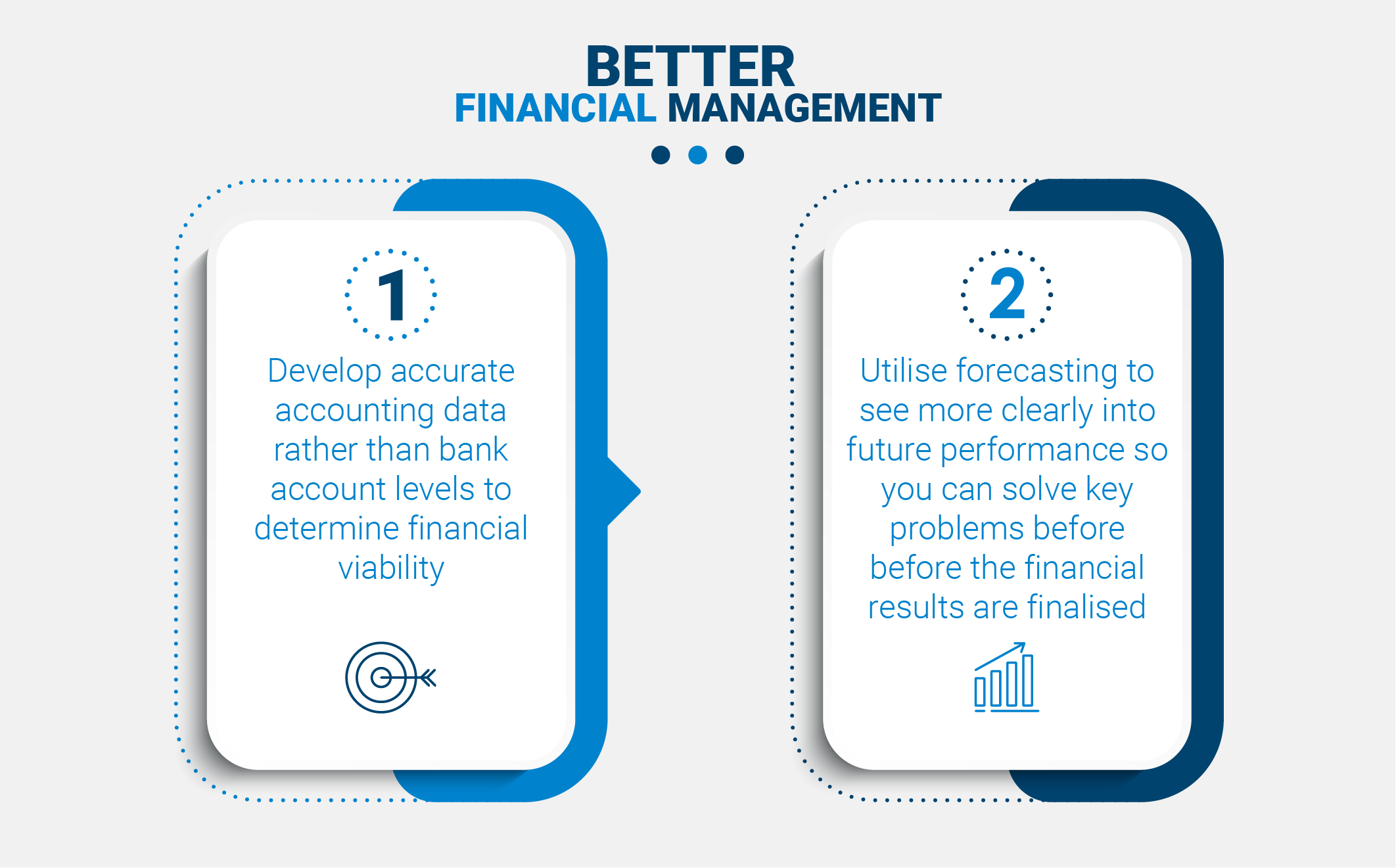

Understand it takes less time to keep your cash clear than it does to manage the stress and problems that stem from flying financially blind.

If you don’t have a basic budget, create one immediately. If you have an accountant available for the task, utilise them. If not, ask Google! Ignorance on how to do things is not a valid excuse.

Clarify the flow of money going in and out of your business each month. Then work on creating a forecast for what your revenues should be over the next 3-12 months, depending on your business type. The longer it takes you to recognise revenue the longer your time horizon should be.

Lastly, review the information often. Identify the weak links you find in obtaining a strong revenue base and work towards strengthening them. Then sit back and congratulate yourself on moving from a reactive to proactive state in one of the most important areas of your business and alleviating a heap of work stress.

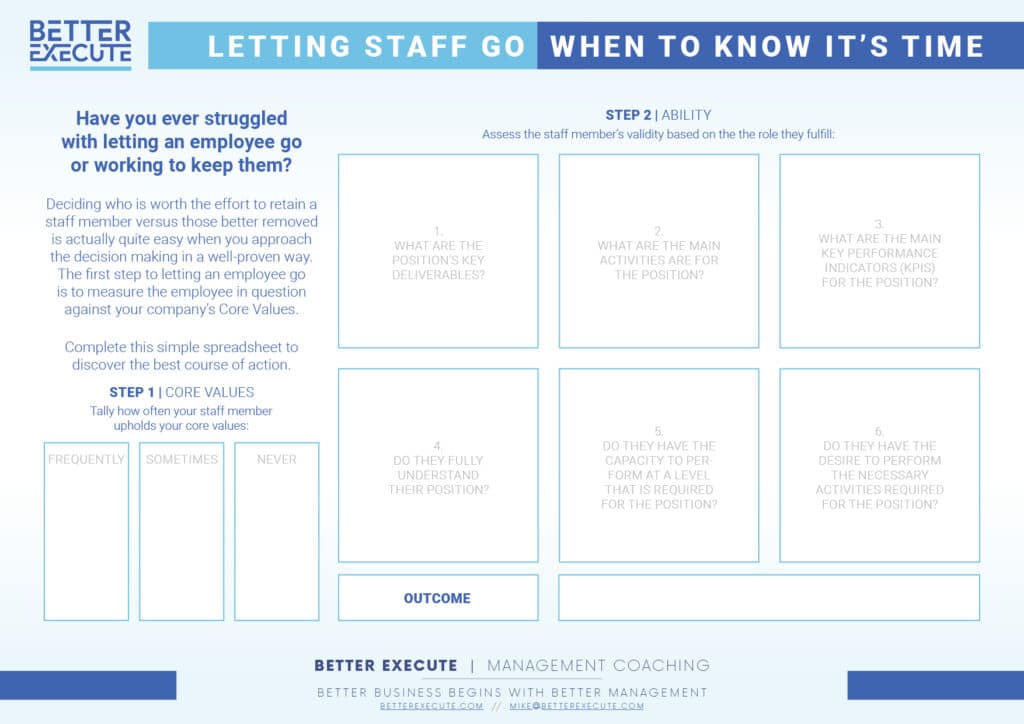

Improve Your Team’s Clarity on How to Help

If you are paying someone to help you grow the profitability of your business, you owe it to yourself and them to be crystal clear on what you expect from them.

Start with your most valuable and strategic team members. Ask yourself whether what they bring to the business justifies the cost to the company. Then ensure that they have clarity around their specific role and the responsibilities it has.

Question #1 – what is the position accountable for delivering (and be specific)? Question #2 – how will everyone know the person in the position is delivering on what they are accountable for? These should be KPIs or KPRs.

Review these points of clarification with the staff member and get their feedback. Once you reach an agreement on what is required of the position, ask yourself whether the person in the role:

- Understands the position

- Is motivated by the position

- Has the required skills to be successful.

If any of the answers are negative, you will need to do more work on either training them, moving them to another seat, or moving them out of your company. Regardless of which path is required, it is far better than not receiving are paying for.

Create a Weekly Management Meeting

If you don’t set a time each week where you can identify, discuss and resolve key issues facing your company you are guaranteed to have chronic levels of work stress. This is likely to have negative effects on your health and overall quality of life.

Most business leaders meet with their team once a week. Ensure a key component of each meeting is to discuss issues – usually the last agenda item of the meeting. Then break the discussion into three steps:

Step 1 – Identify the issues or concerns people see within the company. This could be with customers, employees, processes, technology, safety, productions, etc. When people bring up an issue, don’t settle for the initial problem description. Define precisely what the problem is. Rarely does the first description do so.

Step 2 – Once the core problem has been identified, invite the team to add their insights for how they see the problem occurring and ideas for solving it. Most of this should focus on ‘what’ the problem is rather than on ‘how’ to fix it.

Step 3 – Identify a solution that has clear owners for each of the required activities and set defined deadlines. Be sure these tasks are reviewed at the following meeting to ensure the issues remain visible until they are fully resolved.

By implementing one to all three of these strategies we have little doubt you will both reduce your amount of chronic work stress but also see an improvement in your profitability and team morale. Your business should be a tool to improve the quality of your life – not rob you of your health and vitality. Like any powerful tool, if not used correctly it can be highly destructive. Take some quick initial steps toward improving how you manage your company and it won’t take long to begin feeling the health benefits that will come from it.

Enjoy the process!